Paying tax is part of the deal when running a business, but that doesn’t mean you have to pay more than necessary. Ive been told hundreds of time by my father that ‘paying more tax means you’re earning more money!’— this is true, but the aim is to keep that tax bill as low as possible. One way to do that in a company is by setting up a holding company structure.

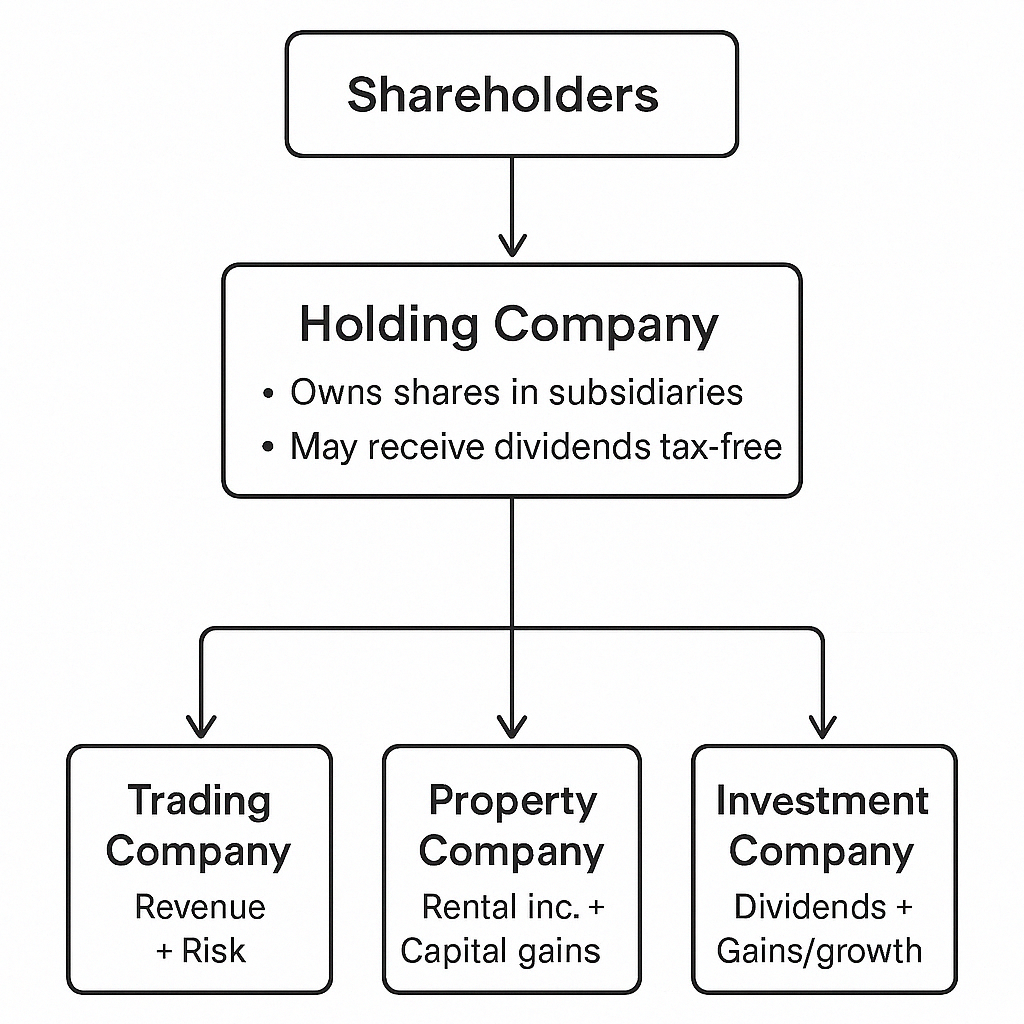

Here’s how it works: You have your main company, called the holding company, which owns several smaller companies underneath it (subsidiaries). When these subsidiaries make money, they can pay dividends to the holding company, and these dividends are usually tax-free (less company profit in the subsidiary, less tax in that subsidiary). This means you can move profits between the companies without triggering extra tax charges.

This structure also helps protect valuable assets. For example, you can keep assets and property in separate companies. If one of your businesses runs into trouble, these assets stay protected in the holding company.

On top of that, you can use the structure to move money around in a way that reduces your tax bill. You could allocate profits between the companies to take advantage of lower tax rates or certain reliefs.

It’s not something you can set up without careful planning, and you’ll need tailored legal and tax advice, as the right setup depends heavily on your specific business structure, goals, and circumstances. But when done correctly, a holding company setup can save you money on tax, protect your assets, and give your business more flexibility.